Session #2 - Principles of Entrepreneurial Finance

Session #2 - Principles of Entrepreneurial Finance

In short, we can define Entrepreneurial Finance as the “application and adaptation of financial tools and techniques to the planning, funding, operations, and valuation of an entrepreneurial venture.” There are seven key principles of entrepreneurial finance that we need to understand before going into business.

7 Principles of Entrepreneurial Finance - Entrepreneurial Finance, Leach & Melicher

- Real, human, and financial capital must be rented from owners

- Risk and expected reward go and in hand

- While accounting is the language of business, cash is the currency

- New venture financing involves search, negotiation, and privacy

- A venture’s financial objective is to increase value

- It is dangerous to assume that people act against their own self-interests

- Venture character and reputation can be assets or liabilities

One of the most important commodities for entrepreneurs is free cash - the cash exceeding that is needed to operate, pay off debts, and invest in assets. Free cash flow is basically the change in free cash over time. These two are highly important concepts to grasp because Cash is King - it is the lifeblood of a business. Profit is great, but it means nothing without positive free cash flow (unless you have just invested in future assets).

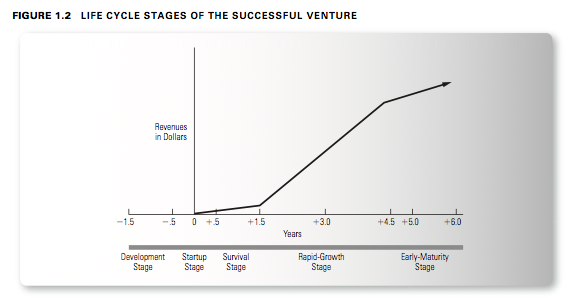

The Successful Venture Life Cycle - There are five stages that can be considered when looking at the life cycle of a venture. All ventures start at the development stage, pass through growth stages, and end-up in a mature stage.

(Entrepreneurial Finance, Leach & Melicher)

(Entrepreneurial Finance, Leach & Melicher)

Each of these stages have various financing needs and sources, which are described in the figure below. It is important to note that most companies and entrepreneurs go through the same cycle when it comes to financing. First, the entrepreneur uses his or her own savings, along with friends/family assets, to finance the development stages. The next round of financing usually comes from Angels and potentially Venture Capitalists. The third round of financing, which is typically the largest, comes from large bank loans and venture capitalists.

(Entrepreneurial Finance, Leach & Melicher)

(Entrepreneurial Finance, Leach & Melicher)

As mentioned before, cash is the lifeblood of a new venture. As entrepreneurs we need to create a sustainable model that will allow us to have free cash flow during the start-up and survival stages of our business. Cash flow will allow us to invest in new opportunities, operate our business, and pay our debts.

See you during Session #3 - Business Plans & Investors!

DIA

PS - Note that all info is summarized from my Entrepreneurial Finance class at Hult IBS, and the Entrepreneurial Finance 4th edition textbook by Leach & Melicher (highly recommended).

Pingback: Entrepreneurial Finance - Key Characteristics of an Entrepreneur - The Dia Project